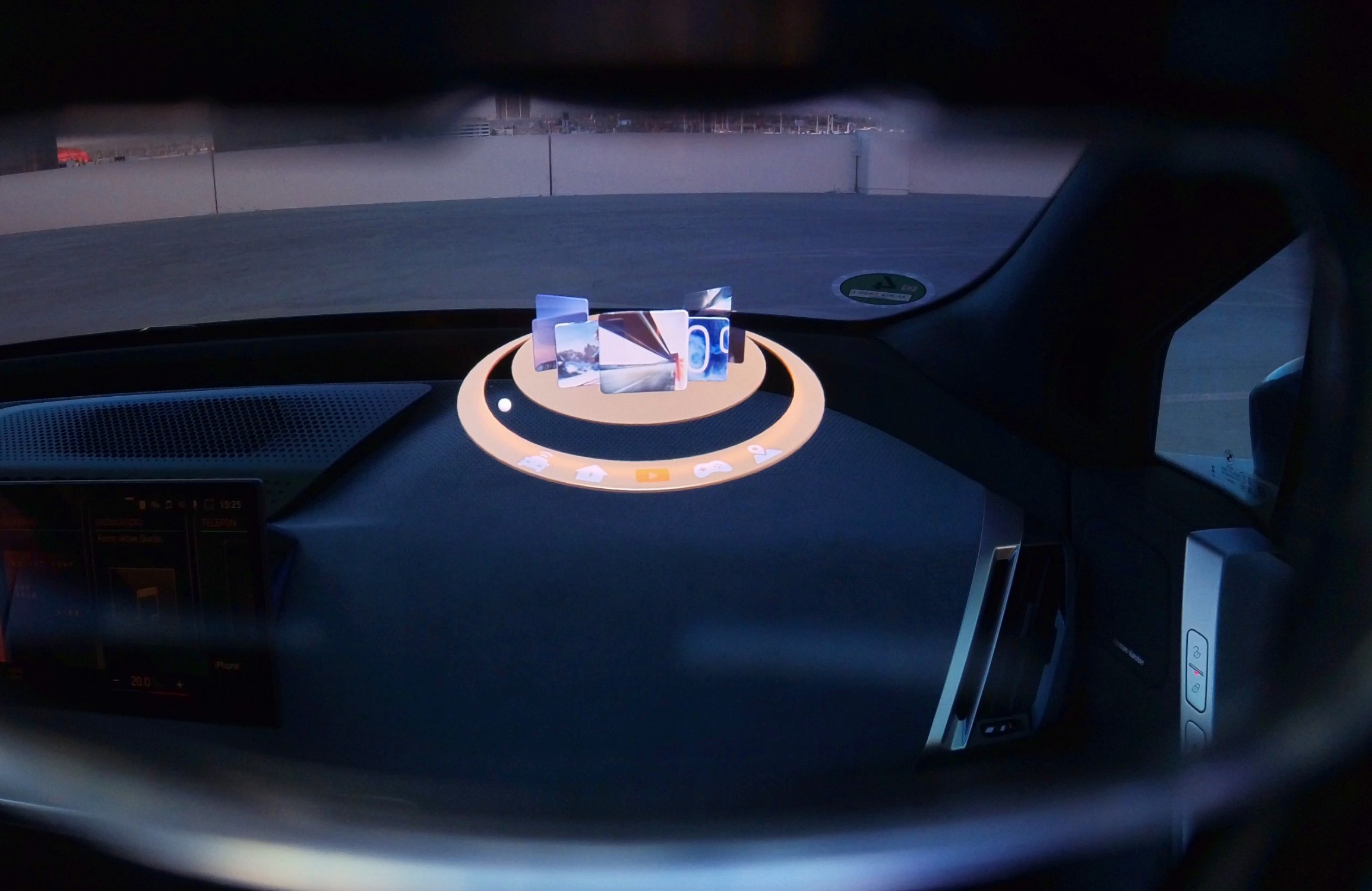

| From tech giants such as Intel to auto industry manufacturers like Bosch, BMW and General Motors, artificial intelligence – AI – is the phrase that pays.CES 2024 will mark the start of an auto industry’s AI arms race, analysts and industry executives said this week. But as Reuters colleagues Max Cherney and Abhirup Roy point out, it is not clear what AI features consumers will pay for, especially in vehicles. Today’s less complex digital dashboards drive consumers crazy. Industry executives say AI could help. AI could enable drivers to speak naturally to their dashboards. “Hal, please turn off the radio,” could replace stabbing through menus on a touch screen. AI could improve the quality of monitoring systems that detect when drivers are drowsy or distracted, enable more precise detection of hazards on the road or make it easier to get directions. The questions about AI business models are bigger than the auto industry. But AI presents a significant new challenge to automakers already struggling to generate revenue from next-generation vehicle software. “Automakers are trying to get the trains running on time. Tech companies are trying to push the envelope of what can happen,” Alixpartners automotive practice leader Mark Wakefield said this week, presenting a study that concludes legacy automakers are well behind Tesla and Chinese EV startups in developing vehicles with smartphone-level software systems. Google, Apple and other digital technology companies have a head start in providing digital services to drivers via smartphones. Will consumers pay automakers hundreds of dollars to talk to a map in the dashboard if they can get an AI-infused map for free on their phones? Great question. |